31+ 62.5 cents per mile calculator

Web Since the driver used the car for business purposes 50 of the time the actual expenses deduction is 4750 9500 x 50 4750. As of 2009 these are the IRS.

Cost Per Mile Calculator Rigbooks

Web For reference here is what the equation looks like.

. Web Responding to record-high gas prices the IRS announced yesterday that for July through December of 2022 the optional standard mileage rate for business travel. Web Use the mileage calculator to find out different rates and miles driven. How much will I be.

31 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the 585 cents per mile rate. If you are using this for IRS reasons put in the value assigned by the IRS for that year in use. Web The 2023 standard mileage rate is 655 cents per mile.

The IRS has set this rate in 2022 at 625 cents for July-December and 585. Web Effective July 1 through Dec. Miles rate or 175.

Web Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Web For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Cents per Mile Value of Award 100 x value of award taxes fees paid miles used miles foregone Example 1.

Cost Per Mile Calculate. Reimbursement rate but keep in mind that the IRS will. Below is a chart of the total amount based on the cost per mile rate and the miles driven.

Using these same figures. Web Effective July 1 through Dec. Web Calculate your mileage reimbursement or deductions for 2022 according to the IRS standard mileage rates.

For 2022 Returns the mileage. 31 2022 the standard mileage rate for the business use of employees vehicles will be 625 cents per milethe highest rate the. Web IRS Standard Mileage Rates from Jan 1 2023.

Web How much will I be reimbursed at 625 cents per mile. Type into the calculator and click calculate. Web Beginning July 1 the Internal Revenue Service is pushing up its optional standard mileage rate for business use to 625 cents per mile.

655 cents per mile for business purposes. Centskilometer 3106856 US. Web When doing your calculations multiply the miles you drove business charity etc by the cent amount for the year in question.

To find your reimbursement you multiply the number of miles by the rate. Web The standard mileage rate is the fixed amount an employer can deduct as a business cost per mile. Web Beginning on January 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

22 cents per mile for medical and moving purposes. Web The default is 55 cents per mile but that is modifiable. Thats up 4 cents a mile.

585 cents per mile driven for business use. Web You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving.

Solved Q 1 The Cost Per Mile For A Rented Vehicle Is 1 00 Chegg Com

Cost Per Mile Calculation Truckingsuccess Com

Ultimate Aptitude Tests Pdf Book Free Download By Pdfbooksinfo Issuu

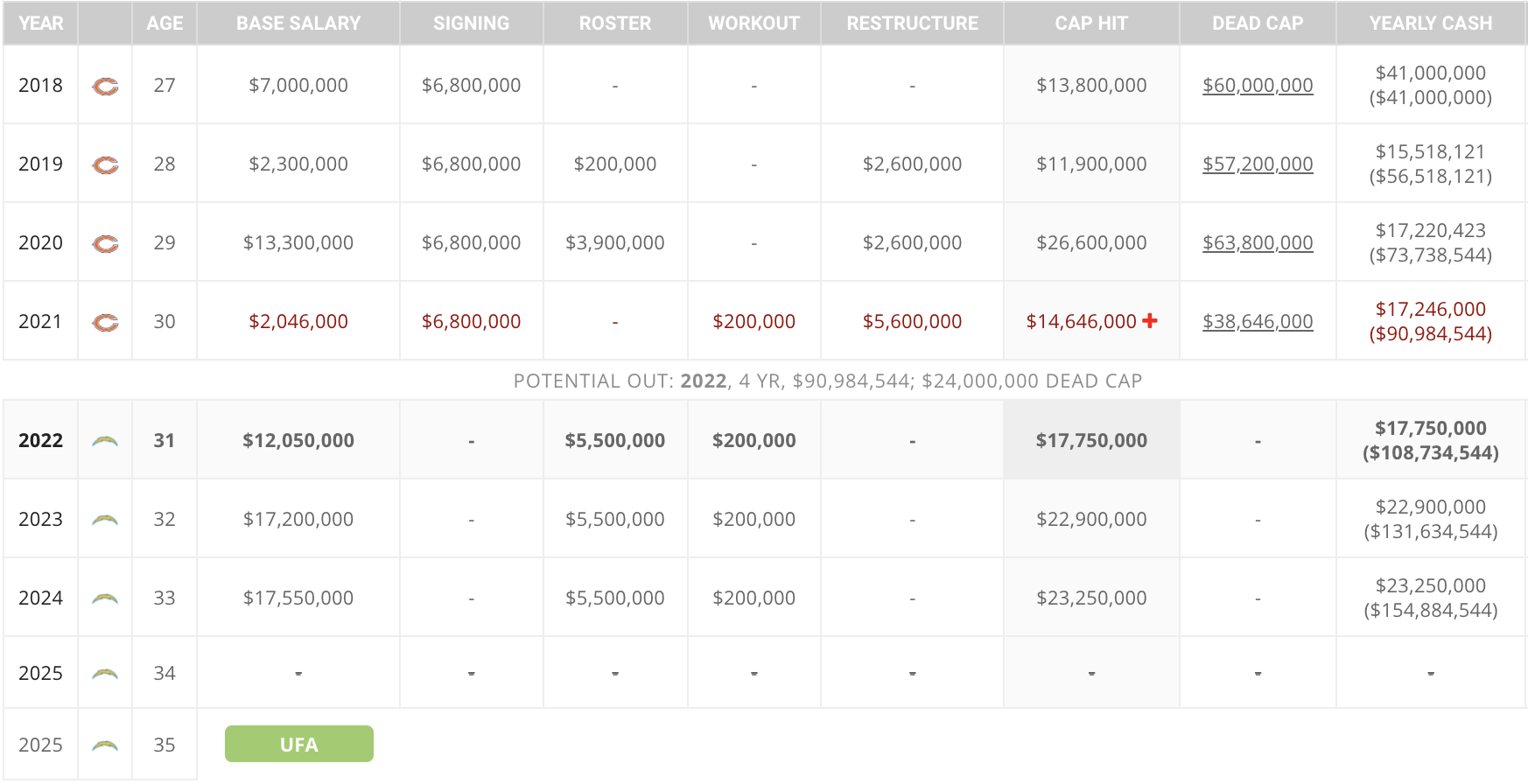

Spotrac Research News Reports

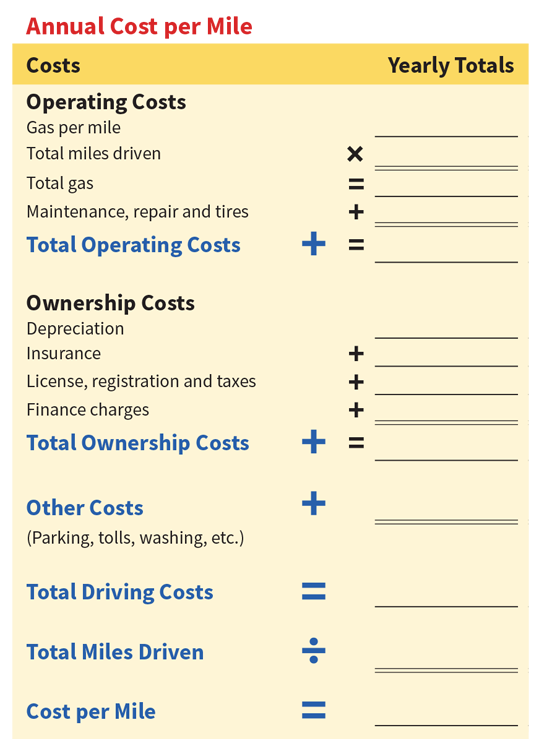

Aaa S Your Driving Costs Aaa Exchange

Country Folks East 8 20 12 By Lee Publications Issuu

Aaa S Your Driving Costs Aaa Exchange

Mileage Calculator Credit Karma

Cost Per Mile Of Driving Calculator Calculator Academy

Pdf Introductory Statistics Rocket Inc Academia Edu

Free Irs Mileage Calculator Calculate Your 2022 Mileage Claim For

Cost Per Mile Calculator Demo Youtube

Introductory Statistics

Spotrac Research News Reports

Calculate Your Cost Per Mile

Cpm Cost Per Mile How Much To Maintain My Truck Donahue Truck Centers Ventura California

Collaborative Statistics Dobrodoa Li U Web Mef